Pradhan Mantri Suraksha Bima Yojana: A Comprehensive Guide to Financial Security

Introduction

In a country like India, where unforeseen accidents and mishaps can disrupt lives and leave families in financial turmoil, it is essential to have a safety net in place. To address this concern and promote financial inclusion, the Indian government introduced the Pradhan Mantri Suraksha Bima Yojana (PMSBY) or Prime Minister's Personal Accident Insurance Scheme. In this blog post, we will delve into the details of this scheme, its benefits, and how you can enroll to secure yourself and your loved ones.

1. What is Pradhan Mantri Suraksha Bima Yojana?

Pradhan Mantri Suraksha Bima Yojana is an accident insurance scheme launched by the Government of India to provide affordable insurance coverage to all Indian citizens. It aims to offer financial protection in the event of accidental death or disability caused by accidents.

2. Key Features and Benefits

2.1 Eligibility Criteria

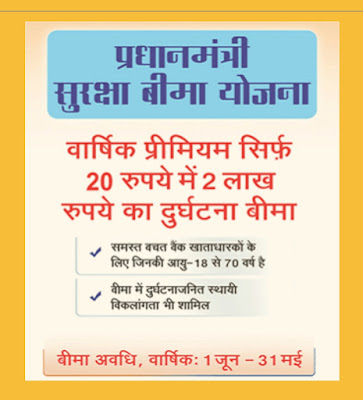

To avail the benefits of PMSBY, you must meet the following eligibility criteria:

- Age: 18 to 70 years

- Bank Account: Must have a savings bank account in any participating bank

2.2 Affordable Premiums

One of the significant advantages of PMSBY is its affordable premium. For just a minimal premium of Rs. 20 per year, you can get insurance coverage of Rs. 2 lakh for accidental death and permanent total disability and Rs. 1 lakh for permanent partial disability.

2.3 Coverage for Multiple Accidents

PMSBY covers accidents arising from various sources, including road accidents, natural calamities, fire, drowning, and other mishaps. The policyholder is eligible for the insurance amount irrespective of the cause of the accident.

2.4 Worldwide Coverage

The coverage under PMSBY is not limited to India; it extends to accidents worldwide, providing a sense of security for individuals traveling abroad.

2.5 Renewable Scheme

The PMSBY scheme is renewable on an annual basis. By ensuring the timely payment of premiums, policyholders can continue to enjoy the benefits and stay protected.

3. How to Enroll in Pradhan Mantri Suraksha Bima Yojana?

3.1 Approach Participating Banks

To enroll in PMSBY, visit any participating bank where you hold a savings account. Fill out the enrollment form and submit it along with the premium amount to the bank.

3.2 Self-Enrollment through Digital Platforms

Many banks also offer the facility to enroll in PMSBY through their mobile banking applications or internet banking portals. Check with your bank to see if this option is available.

4. Claim Process

In case of an unfortunate accident resulting in death or disability, the nominee or the insured person can initiate the claim process. Follow these general steps to file a claim:

- Inform the bank about the incident as soon as possible.

- Submit the necessary claim documents, such as the claim form, FIR (if applicable), medical records, and other supporting documents.

- The bank will evaluate the claim and disburse the insurance amount to the nominee or the insured person, as per the policy terms.

Important Link

Visit Official Website : https://jansuraksha.gov.in/

પ્રધાનમંત્રી સુરક્ષા વીમા યોજનાની ગુજરાતીમાં માહિતી મેળવવા : અહીં ક્લિક કરો.

5. Conclusion

Pradhan Mantri Suraksha Bima Yojana is a crucial initiative by the Indian government to provide financial security to individuals and their families in the face of accidental mishaps. By enrolling in this scheme, you can enjoy affordable insurance coverage, ensuring peace of mind and protection against unforeseen circumstances.

Remember, accidents can occur at any time, and being prepared with a safety net like PMSBY can make a significant difference in your life. So, take the necessary steps to enroll in this scheme and secure your

No comments:

Post a Comment